37+ age requirement for reverse mortgage

102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling. Ad Reverse Mortgages Are More Common Than You Think.

Lake Charles Area Home Finder S Guide November 2022 Volume 37 Issue 5 By Digital Publisher Issuu

All About Reverse Mortgage For Seniors.

. Web For example some reverse mortgage programs specify that the final maturity date is the borrowers 150th birthday. 2 Home qualifications HUD and FHA rules. Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near traditional retirement age.

Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Additionally theyll consider the following when determining how much you can take out. Web 102633 Requirements for reverse mortgages.

Web If youre 62 or older you might qualify for a reverse mortgage. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. But are these mortgages all that great.

All homeowners on title must be aged 62 years or over. Ad While there are numerous benefits to the product there are some drawbacks. In some cases you might be able to get one if youre younger for example after turning 55.

Web For government-insured HECMs and for state or local government-sponsored single-purpose loans the minimum age is 62. Learn Why Retirees Trust Longbridge. No personal information is required to calculate your estimate.

There are no monthly principal. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes.

To be eligible for a reverse mortgage otherwise known as a Home Equity Conversion Mortgage HECM the borrower or. Members of Generation X born. Reverse mortgages are complicated risky and.

Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. You should have a sufficient amount of equity built up in your home.

Web The enhancement lowers the minimum qualifying age for homeowners applying for this reverse mortgage product from 60 to 55 years of age in certain states. Web Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment. Start by inputting your property type estimated home value ZIP code.

Ad Looking For Reverse Mortgage Calculator. Reverse Mortgages Have Helped Thousands of Retirees. 1 General requirements age 62 is a homeowner others.

Ad Reverse Mortgages Are More Common Than You Think. Eligibility for reverse mortgages depends on. You will have less.

With a reverse mortgage the amount of money you can borrow is based on how much equity you have in your home. Web A main drawback of a reverse mortgage is that you could have fewer resources to pass on to heirs. A reverse mortgage enables you to withdraw a portion of your homes equity to supplement your income or to purchase a home.

It is called a reverse mortgage because instead of. Web You generally arent eligible for a reverse mortgage until you reach age 62 and the older you are after that the more youre often able to borrow. Reverse Mortgages Have Helped Thousands of Retirees.

Learn Why Retirees Trust Longbridge. Web Below are some qualifications and requirements as well as other obligations. Most reverse mortgages today are called HECMs insured by the Federal Housing Administration FHA.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Web Web Up to 25 cash back Usually the minimum age for requirement a reverse mortgage is 62. 102637 Content of disclosures for certain mortgage transactions Loan Estimate.

Learn About This Mainstream Movement. Web A type of loan that typically allows homeowners age 62 or older to borrow against the equity in their homes. An itemization of loan terms.

Learn About This Mainstream Movement. The loan balance generally increases over time and interest can accumulate. Web While there are generally no income or minimum credit score requirements to qualify for a reverse mortgage a main eligibility factor is age.

Your Reverse Mortgage Advisor can help you determine if you have enough equity to qualify. Web For HECMs lenders will typically look for at least 50 equity in the home. While the specific percentage of equity.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Most jumbo reverse mortgage lenders also require applicants to be 62 but a. Ad Looking For Reverse Mortgages Seniors.

Web Up to 25 cash back Usually the minimum age for requirement a reverse mortgage is 62. Your equity is how much money you could get for your home if you sold it minus what. Your ability to pay property taxes and.

Key Takeaways With a reverse mortgage your loan balance grows over time and the younger you are the. You must pay off any existing.

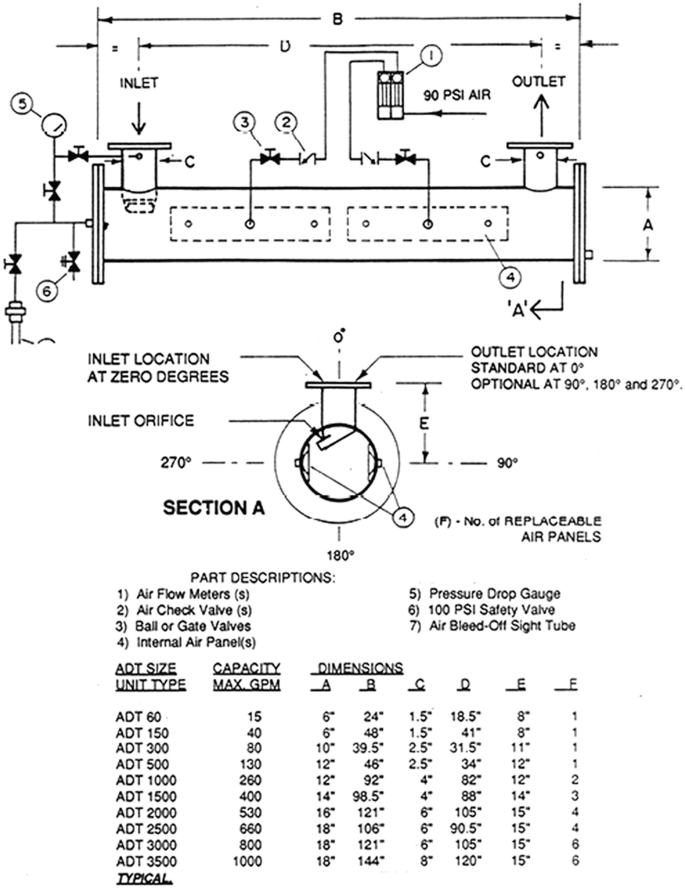

Humanitarian Engineering Education Of The Lenox Institute Of Water Technology And Its New Potable Water Flotation Processes Springerlink

Reverse Mortgage Age Requirement When To Get A Reverse Mortgage Loan

Lov5q6rz2goqwm

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Lake Charles Area Home Finder S Guide November 2022 Volume 37 Issue 5 By Digital Publisher Issuu

Discover The Latest Age Requirements For Reverse Mortgages In 2023

How Does Reverse Mortgage Age Limit Affect Your Eligibility

Retire Better With A Tax Free Reverse Mortgage Loan Jersey City Nj Patch

10 Reasons To Avoid Reverse Mortgage Loans Mybanktracker

What Happens When You Take A Reverse Mortgage But Your Spouse Does Not Housingwire

35 Mortgage Definitions And Terms To Know

Monica Culey Mortgage Broker In Kenmore Mortgage Choice

The Answers To Common Reverse Mortgage Questions

:max_bytes(150000):strip_icc()/GettyImages-1193367476-2222f52da6d247f7a43eafeba1da7b12.jpg)

How Age Affects Your Reverse Mortgage Payout

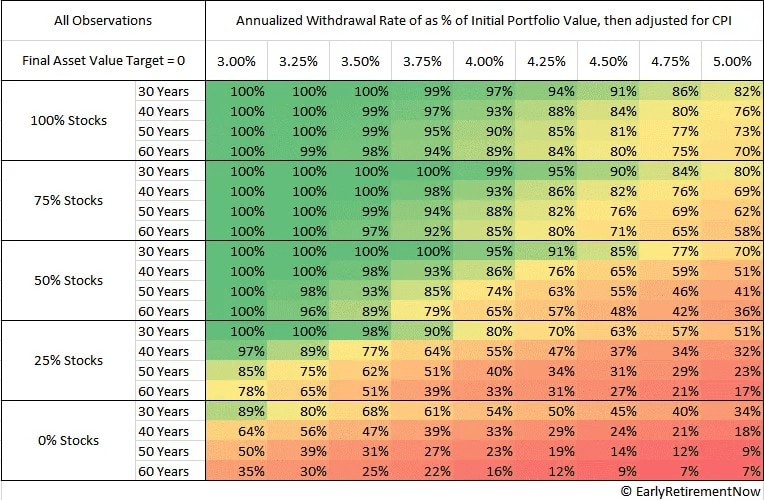

Safe Retirement Withdrawal Rate Strategies In Canada Million Dollar Journey

Selling A House With A Reverse Mortgage What To Know

Reverse Mortgage Eligibility Requirements